Wealth Management Tailored to You.

At High Ridge Advisory, we help clients balance their current and future financial needs. We see wealth as a tool for purposeful living, not the main focus of decisions.

From the beginning and throughout our relationship, we create comprehensive wealth plans that ensure all parts of your financial net worth work together. Simplifying the complex, we serve as a trusted resource to help you confidently design, implement, and evolve your planning over time.

We provide tailored planning solutions for both families and businesses, offering personalized guidance and support. Whether you want to secure your financial future, grow your business, or create a legacy, we are committed to helping you achieve your goals with innovative and effective strategies.

Family Wealth Solutions

We help individuals and families build, grow, and protect their wealth. Whether you’re seeking help with retirement and estate planning, trusts and wills, or college planning, our goal is to assist with financial planning needs as your financial situation evolves.

Retirement Planning

Retirement Income Planning

Social Security Analysis & Timing

Educational & College Planning

Investment Strategy & Design

Customized Tax-Managed Investment Strategies

Professionally Managed Retirement Plans

Employer Stock Option Optimization & Planning

Guaranteed Income & Annuity Planning

Life, Disability, and Long-Term Care Insurance Planning

Tax Planning & Minimization Strategies

Estate Planning & Legacy Planning

Multigenerational, Philanthropic, and Gifting Strategies

Asset Protection Strategies

Family CFO Services

Business Planning Solutions

For small and medium-sized businesses, our business planning services strive to help owners minimize taxes, retain key employees, and streamline their benefit offerings.

Corporate Retirement Plan Design and Implementation

Solo Owner Retirement Plan Design & Implementation

Cash Balance Pension Plans

Customized Tax-Managed Investment Strategies

Deferred Compensation Plans

Executive Benefit & Key Employee Planning

We Focus on Your Needs Only.

We have no ties to investment firms, specific products, or ready-made platforms. So, you can choose the managers, product, and individual securities that will help you deliver the best results.

We do not try to time the market or predict its behavior. Instead, we run a detailed and thorough analysis of your portfolio every day, assessing risk and performance levels, evaluating current market conditions, and making careful, analytical adjustments. We also track supply and demand activity regularly.

Our mission is to participate when the markets are supportive of higher prices and hedge when market risks are elevated, allowing us to optimize your portfolio’s ability to best meet your goals.

Eric Caisse CFA®, CMT, CFP®

Chief Investment Officer & Partner

Our Proprietary Process Works for You.

Our approach to asset management is called Fusion Analysis and combines three methodologies: fundamental research, technical research, and behavioral science. On a daily basis, we can reallocate asset categories, track manager performance, negotiate pricing, and customize preferences for all investor portfolios. We continually strive to balance investors’ desires for growth with the need to minimize risk and reduce volatility. We believe it’s more important to avoid the big dips than chase the high flyers.

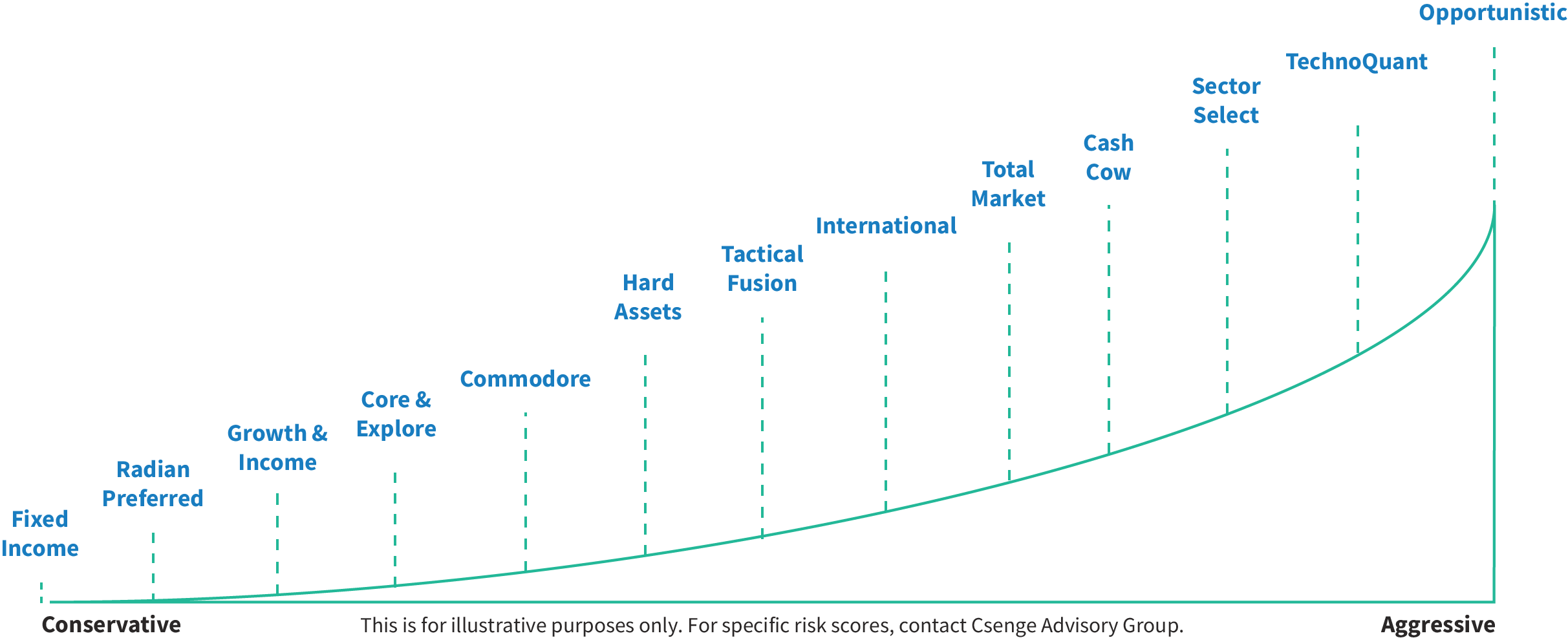

Asset Allocation Models for Every Investor.

We offer 13 asset allocation models that range from fixed income to total market exposure, meeting most investors’ needs. We also provide custom-crafted asset allocations for specific situations.

High Ridge Advisory can help you determine your risk score and preference.